Analytics-Driven Personalisation: Redefining the Customer Experience in Banking

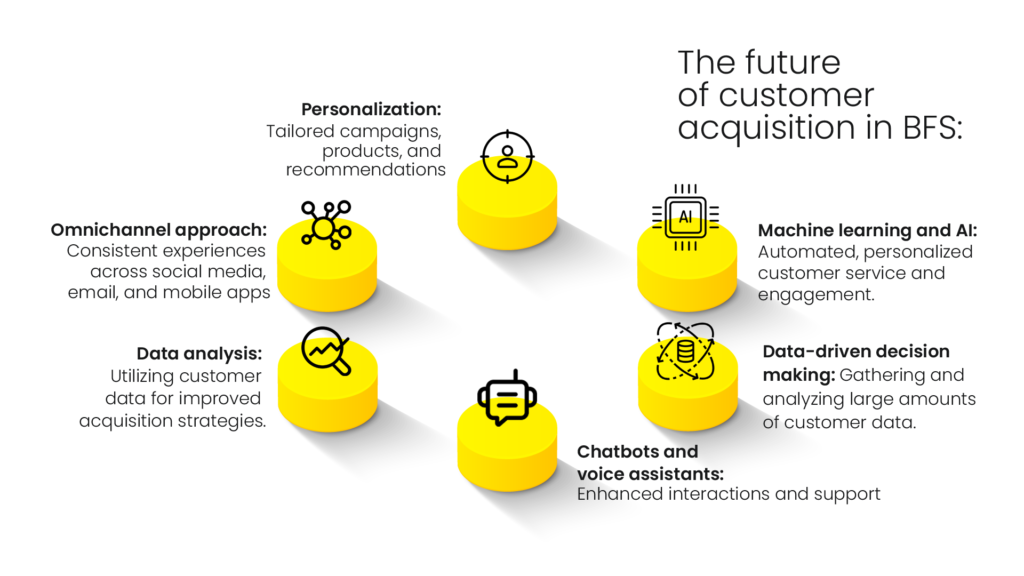

Analytics-driven personalisation is the biggest recent trend that has completely changed the game in terms of enabling personalised banking along with improved customer experience in banking. Digital transactions, payments, and banking platforms have completely changed the modus operandi as far as both customers and executives are concerned. At the same time, the higher digital engagement and transaction volumes lead to the generation of huge amounts of data on a daily basis. This is in the form of both non-transactional and transactional information. Banks are now finding several merits in tapping and analysing this data to gain invaluable insights for positively transforming customer experiences and processes. Technologies like banking analytics are being used in tandem with machine learning, artificial intelligence, and big data analytics to generate the best possible results for banks in this context. Even McKinsey Global has stated how data-driven entities are 23 times likelier to acquire new customers, while being six times likelier to retain them and 19 times as likely to be profitable due to this aspect. Another key aspect lies in the fact that banking analytics or data analytics in this segment had a value of approximately $4.93 billion in 2021 and is estimated to hit $28.11 billion within 2031 (indicating compounded annual growth rates or CAGR of 19.4%). There are several data or touch points for customers including websites, mobile apps, digital transactions, social media platforms and a lot more. Rich data can be used for redefining customer experiences while also predicting customer engagement and mapping the journey. How Analytics-Driven Personalisation is the Key Factor When it comes to offering personalised banking and redefining customer experiences, big-data analytics is the key element that institutions are looking to leverage in the current scenario. Here are some pointers worth noting in this regard. Several banks and financial institutions have multiple products for customers which cater to varying requirements. Redefining customer experiences thus becomes a major differentiator for these financial institutions in order to enhance customer satisfaction and retention levels alike. Gaining a better understanding of customers and identifying gaps or potential issues will also help improve the overall experience for customers while enabling more personalisation at the same time with full scalability. What are the challenges of data analytics in banking? There are a few challenges of leveraging banking analytics that institutions also need to be aware of. These include: However, analytics-driven personalisation is the biggest trend that will completely reshape customer experiences across banks and financial institutions. Customers now engage across several touchpoints and expect more personalised banking solutions and quick assistance and support for their queries. Hence, institutions will have to rely more on data analysis and insights to make better decisions that lead to improved customer experiences and higher retention. However, maintaining a customer-centric approach is the biggest takeaway that banks should keep at the forefront while scaling up data analytics initiatives simultaneously. FAQs Analytics-driven personalisation greatly enhances the banking experience for any customer. Banks get a full view of the customer profile and specific needs, pain points and requirements. Hence, they can customise their offerings and solutions to meet these needs while solving the pain points and making sure that the customer gets the right solutions at the right time. Both transactional and non-transactional data are used for driving analytics-driven personalisation in banking. This includes data directly gathered from transactions across multiple channels and also other data from surveys, forms, websites, mobile applications, social media platforms and many other sources. There are a few considerations and challenges that banks should keep in mind while implementing personalisation through analytics. Data quality and integrity should be a major focus area, since poor quality may completely jeopardise the whole process. Other considerations include data silos, gathering disparate data across systems, integration and dealing with legacy infrastructure. With more personalised services and engagement, customer experiences naturally improve over time. This leads to higher loyalty and superior engagement since customers get solutions tailored to their needs and their pain points are addressed by banks swiftly due to analytics-driven insights.