Bajaj Allianz Life Insurance is a prominent player in the Indian insurance market, offering a diverse range of life insurance products. Known for its commitment to customer-centric services and innovation, the company strives to deliver comprehensive financial solutions that cater to the diverse needs of its clients, enhancing financial security and peace of mind.

Bajaj Allianz Life Insurance faced challenges in their Management Information System (MIS) reporting process, characterized by manual interventions and inefficiencies.

Despite these hurdles, Cipla aimed to create a seamless experience for its users, reinforcing its commitment to innovation and accessibility in healthcare.

INT. offered Dedicated Managed Resources to streamline MIS reporting at Bajaj Allianz Life Insurance, reducing manual effort and enhancing overall decision-making efficiency.

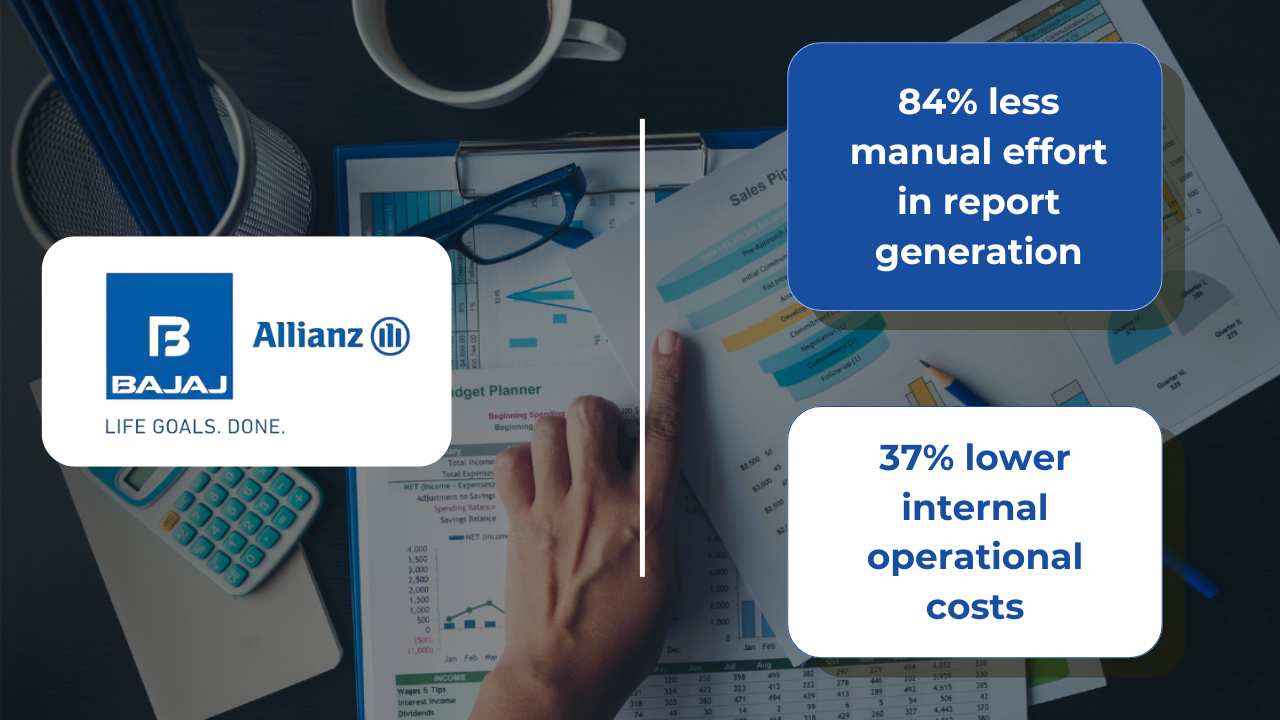

INT.’s Managed Services approach significantly transformed Bajaj Allianz Life Insurance’s MIS reporting process, leading to measurable improvements:

Reduction in manual effort for report generation

Decrease in internal operational costs

We see INT. as a future partner for their own expansion. After almost a decade of working together, we will need INT’s support for our new steps in the growing markets.