The 1–5% Revenue Leak Insurers Don’t See, Until Automated Commission Reconciliation Exposes It

Commissions are the lifeblood of insurance distribution. Brokers, MGAs, and insurers depend on them to keep operations moving, motivate partners, and maintain healthy financial cycles. But behind the scenes, one of the most crucial financial processes in the industry, commission reconciliation, continues to rely on spreadsheets, manual checks, and outdated workflows.

The result?

Backlogs, errors, incorrect payouts, compliance exposure, and frustrated partners.

The Real Problem: A System Built on Spreadsheets

Despite years of digital transformation, the insurance ecosystem continues to depend heavily on Excel for reconciliation.

What the data reveals

-

88% of spreadsheets contain errors; even “well-built” ones suffer from formula inconsistencies

-

94% of finance teams still use Excel for month-end close

-

Many agencies spend 10–15 hours per week processing commissions before month-end

-

Cash reconciliation alone consumes 20–50 hours per month

When the industry relies on spreadsheets to process tens of thousands of transactions, error is not a possibility; it is a guarantee.

But understanding the scale of spreadsheet dependency is only the beginning. To see why reconciliation fails so often, we must examine how these manual workflows behave under real-world operational pressure.

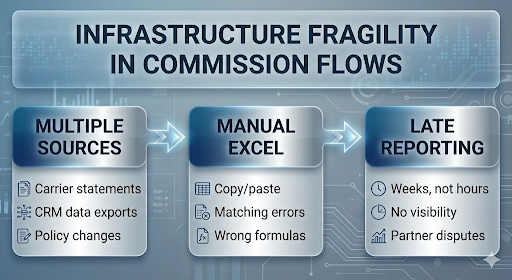

Why Manual Reconciliation Breaks Down

Instead of listing every pain point, here’s the operational reality visualized:

This fragile chain produces real-world consequences:

-

Backlogs grow: A Medicare agency could reconcile 1,000 records/day, but carriers sent 1,000–20,000 per week

-

Errors multiply: Overpayments range from 10–20%, and industry-wide leakage reaches 1–5% of annual revenue

-

Partners lose trust: Delayed payouts and disputes erode broker relationships

-

Compliance risk rises: Without audit trails, even minor discrepancies create exposure

Manual processes are not merely inefficient; they are fundamentally incompatible with the speed, scale, and accuracy required in modern insurance.

These weaknesses aren’t theoretical; they appear in measurable operational breakdowns across the industry. And real-world case studies show just how costly manual reconciliation has become.

Case Study Signals: Automation Changes Everything

Across the industry, organizations adopting automated reconciliation report dramatic improvements. Mito cut reconciliation time from 19 days to 2, cleared backlogs, and saved tens of thousands in erroneous payouts, while Ledge benchmarks show 94% of finance teams still rely on Excel, with cash reconciliation taking 20–50 hours monthly and slowing closes for 50% of teams; meanwhile, Synatic and SANDIS reduced commission processing time by 80–90%, achieved near-100% accuracy, and shortened multi-week runs to just hours.

If automation yields such returns, why are so many insurers still stuck with spreadsheets?

Because most tools only fix one part of the problem. The real issue lives upstream, and that upstream fragmentation is the true barrier to accuracy.

To truly fix reconciliation, we must examine the lifecycle that feeds errors into the system long before commissions are calculated.

Still reconciling commissions in spreadsheets?

If your finance team is spending hours matching carrier statements, chasing discrepancies, or explaining payout errors, the issue isn’t effort; it’s the system.

👉 See how automated, lifecycle-based reconciliation eliminates errors before they reach finance.

The Root Cause: A Fragmented Insurance Lifecycle

Reconciliation errors rarely originate in the reconciliation stage. They originate upstream:

-

Policy updates not synced

-

MTAs implemented late

-

Cancelled policies still present in spreadsheets

-

Claims activity not linked to commission logic

-

Premium receipts out of sync with payout cycles

-

No unified ledger connecting policy → payment → commission

Fragmentation is precisely why incremental tools, macros, and Excel add-ons fail to deliver lasting improvement.

The industry does not need a faster spreadsheet; it needs a unified operating foundation.

INT. Origin—A Unified Insurance Operating System

Most “automation tools” simply patch the final step. INT. Origin transforms the entire chain, a modern, end-to-end insurance operating system, and eliminates it from the ground up.

It is not a reconciliation tool. It is a full-stack insurance operations platform that embeds automated commissions into the policy lifecycle itself, ensuring accuracy before reconciliation even begins.

.png)

This is why INT. Origin achieves outcomes that simple automation scripts cannot. When all capabilities come together, the impact becomes undeniable.

What INT. Origin Solves

1. Commission errors disappear because spreadsheets disappear

INT. Origin replaces spreadsheets with a rule-driven commission engine embedded directly into the policy lifecycle.

It supports:

-

Multi-tier and slab-based commissions

-

Overrides, bonuses, and special agreements

-

Broker, sub-broker, and introducer hierarchies

-

Product-specific, region-specific, and tax-aware rates

All commissions are calculated from live policy, premium, and endorsement data, not copied files, eliminating formula drift, version conflicts, and manual recalculations.

2. Reconciliation happens continuously, not at month-end

Instead of waiting weeks to reconcile carrier statements, Origin reconciles as data arrives.

-

Premiums are auto-matched

-

Discrepancies are flagged instantly

-

Ledgers update in real time

-

Payout instructions are generated automatically

What used to take days or weeks now takes minutes, without backlog buildup.

3. Revenue leakage is stopped at the source

Most leakage happens because commissions are calculated without a unified financial view. Origin maintains a single, immutable policy-to-commission ledger:

-

Every premium, refund, and adjustment is logged

-

Commission events trigger only on valid policy states

-

Cancelled or reversed policies cannot generate payouts

This integrated ledger is what prevents the silent 1–5% loss that spreadsheet reconciliation never catches.

Extended Capabilities

4. Visibility reduces disputes (not more emails)

Instead of chasing finance teams, stakeholders see commission data directly through role-based portals. Brokers, introducers, MGAs, auditors, and ops teams each get exactly what they need.

The result: 30–50% fewer disputes and faster partner settlements.

5. Compliance is automatic, not reactive

Audit trails, historical adjustments, permissions, bordereaux, and regulator-ready reports are generated by default because every commission action is already system-recorded.

Mapping the Industry’s Pain Points to Origin’s Capabilities

|

Industry Pain Point |

Evidence |

Origin Capability |

|---|---|---|

|

Manual spreadsheet errors |

88% error rate; 94% reliance on Excel |

Automated rule-driven commission engine |

|

Slow reconciliation |

10–15 hrs/week; 19 days for 19k records |

Real-time reconciliation |

|

Complex structures |

Multi-tier, overrides, bonuses |

Configurable commission builder |

|

Revenue leakage |

1–5% loss; 10–20% overpayment |

Integrated policy ledger |

|

Lack of transparency |

Partner disputes |

Role-based portals |

|

Compliance risk |

No audit trails |

Full audit log & reporting |

|

Disconnected systems |

CRM, policy, claims isolated |

Unified platform |

Why INT. Origin Is Different

Many platforms claim automation. Few own the entire operational lifecycle.

INT. Origin’s differentiators include:

-

Integrated policy, claims, and accounting workflows

-

Reconciliation powered by a single source of truth

-

Real-time commission engine

-

Multi-role portals

-

Scalability for tens of thousands of records

-

Deep InsurTech integrations

This is not automation layered on top of broken workflows; this is operational reinvention.

Conclusion: Moving the Industry Beyond Spreadsheets

Insurance organizations lose millions annually to errors, inefficiencies, and revenue leakage caused by manual reconciliation. Spreadsheet-driven workflows are fragile, outdated, and incapable of scaling.

The future of commission management isn’t faster spreadsheets; it’s automated, end-to-end operational intelligence. And that future already exists inside INT. Origin.

If your organization is still running commissions through spreadsheets or fragmented systems, the operational and financial risks are growing, not shrinking.

Move Beyond Spreadsheet Reconciliation

INT. Origin provides the unified system, auditability, and automation foundation required to scale safely and profitably.

👉 Let’s explore how Origin can modernize your commission operations end-to-end.

Frequently Asked Questions

1. Why is commission reconciliation such a major problem in insurance?

Commission reconciliation is often handled using spreadsheets and manual workflows that can’t scale with high transaction volumes. This leads to errors, delayed payouts, revenue leakage, and compliance risks—issues that grow as distribution complexity increases.

2. How much revenue do insurers typically lose due to manual reconciliation?

Industry data shows insurers can lose 1–5% of annual revenue due to overpayments, missed adjustments, and undetected errors caused by spreadsheet-driven reconciliation and fragmented systems.

3. Why don’t Excel-based tools and macros solve the problem?

Excel tools only address reconciliation at the final stage. Most errors originate earlier—from unsynced policy updates, endorsements, cancellations, and claims data—making spreadsheets fundamentally unsuitable for end-to-end accuracy and auditability.

4. How does automated commission reconciliation improve accuracy and speed?

Automation enables real-time matching of premiums, commissions, and policy events. Discrepancies are flagged instantly, calculations follow predefined rules, and reconciliation happens continuously—reducing processing time from weeks to minutes.

5. What makes INT. Origin different from other commission automation tools?

INT. Origin embeds commission logic directly into the insurance lifecycle, creating a single source of truth across policy, premium, and payout data. This eliminates revenue leakage at the source, improves transparency, and ensures compliance by design—not after the fact.