Weigh in-house vs outsourced product engineering for fintech startups. Compare costs, security considerations, and time-to-market factors for U.S. fintech scale-ups.

Why This Decision Matters

For U.S.-based fintech CTOs and engineering leaders, choosing to outsource or maintain engineering internally impacts speed-to-market, compliance, scalability, and innovation.

Since 2020, 73% of financial services organizations accelerated digital transformation, reducing mean fintech product lead times from 18–24 months to 6–12 months. Yet, 67% of fintech startups fail pre-Series B, generally due to slow delivery or compliance.

Outsourcing:

Fees: $50–$150/hour for fintech-specialized teams

Savings: 40–60% of direct costs (20–30% net after overhead)

Overheads: Project management (15–25%), QA (20–30%), onboarding delays (4–8 weeks), time zone inefficiencies (10–20%)

In-House:

Salaries: $150K–$250K/year for lead engineers

Benefits & equity: +25–40% of salary

Recruiting: $15K–$30K/hire

Infrastructure: $2K–$5K/engineer/year

12-Month Total:

Outsourced: $500K–$1M

In-House: $1.05M–$1.9M

Security & Compliance

Key Regulatory Needs: SOC 2, PCI DSS, GLBA, CCPA, GDPR, and state-specific laws like NY BitLicense.

Need to launch your fintech MVP in months, not years?

Whether you’re targeting Series A readiness or racing to meet compliance deadlines, our specialized fintech engineering teams can help you deliver faster—without sacrificing security.

Talk to a fintech product expert.

Outsourcing Checklist:

SOC 2 Type II & ISO 27001 verification

Data processing agreements & breach notification clauses

Background checks for vendor employees

Code escrow & IP security

In-House Strengths:

Direct management of protocols

Faster incident response

Easier compliance audits

Drawback: Security expertise is costly and hard to hire.

Speed-to-Market

Outsourcing Advantages:

Immediate team availability

Create DevOps pipelines & compliance templates

Work cycles 24/7 across time zones

In-House Challenges:

Hiring & onboarding: 3–6 months

Learning the domain: 2–4 months

Slower MVP delivery

Typical Timeframes:

MVP: Outsourced 4–6 months | In-House 8–12 months

Series A readiness: Outsourced 8–12 months | In-House 12–18 months

Compliance readiness: Outsourced 6–9 months | In-House 12–18 months

Technical Skills

Outsourcing Strengths:

Payments, open banking APIs, blockchain, fraud detection

AI/ML, analytics, mobile-first design

Broad regulatory expertise

In-House Advantages:

Deep product understanding

IP ownership

Faster internal iterations

Risk & Control

Outsourcing Risks:

Vendor lock-in & IP disputes

Communication or quality gaps

Compliance risks to regulations

Complex vendor exit

In-House Control:

Complete IP ownership

Direct supervision

Alignment with business objectives

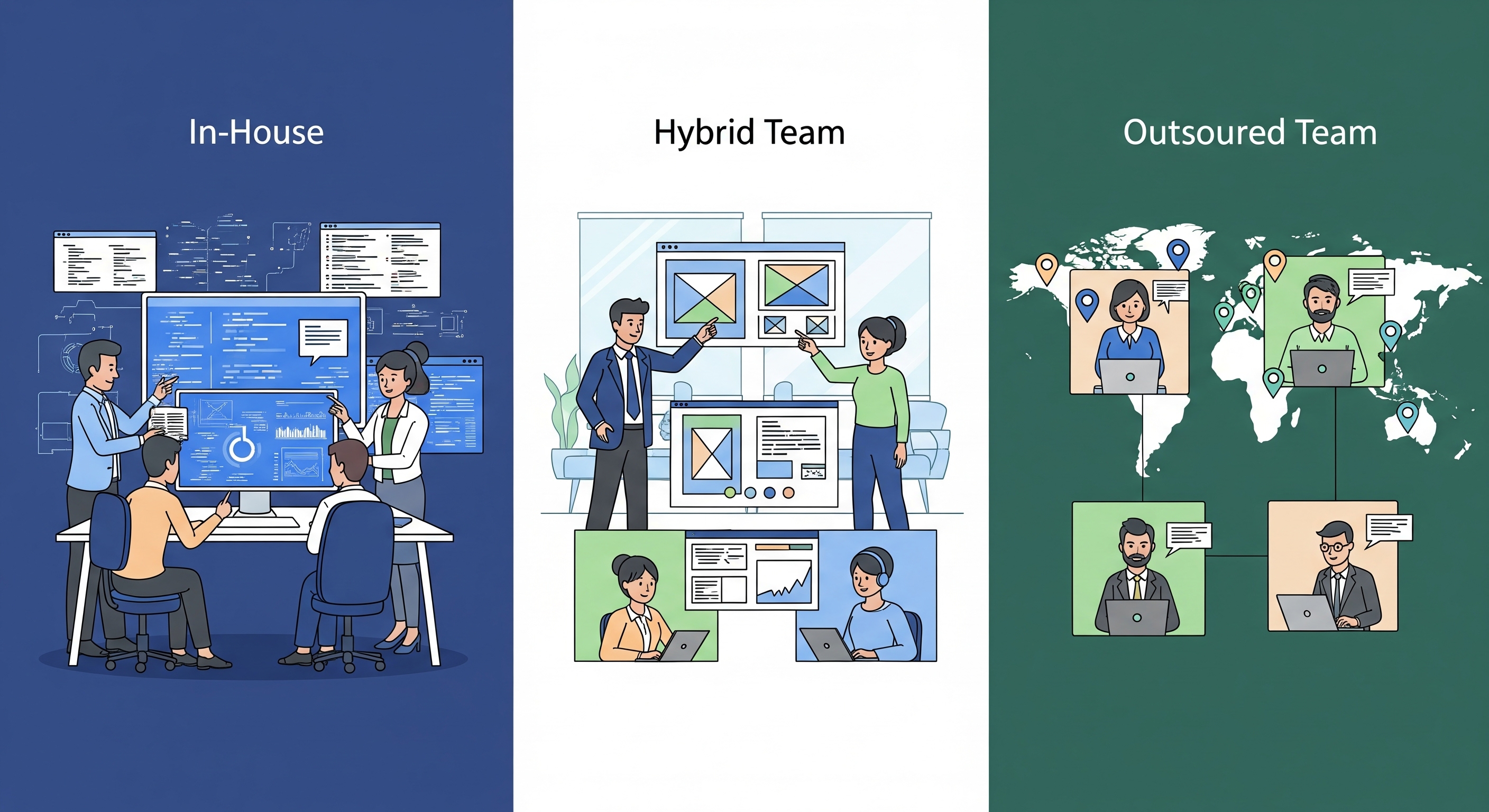

Hybrid Approaches:

Keep core IP internal; outsource non-core modules

Long-term vendor relationships

Gradual knowledge transfer to minimize dependence

Decision Guide for CTOs

Best for Outsourcing:

Can go live in <12 months

Limited internal leadership

Need specialized expertise

Should be able to maximize cash flow

Best for In-House:

The competitive differentiator is proprietary tech

Strong technical leadership

Funding horizon >18 months

High security/control requirements

Hybrid Approach

Variation in complexity by product/feature

Seasonal or project-based loads

Piloting with outsourcing as pathfinding to scaling

Case Studies

Outsourcing:

Digital Lending Startup – MVP within 8 months, SOC 2 compliance 6 months early, $800K in cost savings, and Series A funding achieved ahead of time.

Insurtech App – iOS & Android launch in 6 months, 4.8-star ratings, 60% cost savings, backend in-house.

In-House:

3. Payment Processor—In-house fraud rules, sub-200 ms processing, scaled to $1B+ volume.

4. Crypto Exchange – Complete security control, 99.99% uptime, proprietary trading algos, regulatory ease of compliance.

Future Trends

AI/ML: Proprietary algos at the center; outsource first, then internalize.

Cloud-Native: Scalability is simpler, both models benefit.

RegTech: Compliance by third parties reduces custom build needs.

Hybrid Dominance: Most fintech scale-ups will blend in-house leadership with outsourced expertise by 2026.

FAQs

Q1: Fintechs cost how much less to outsource compared to in-house?

Outsourcing is 40–60% lower in direct cost ($50–$150/hour vs. $150K–$250K/year salaries), but net savings after overhead are roughly 20–30%.

Q2: How do fintechs have security while outsourcing?

Screen suppliers for SOC 2/ISO 27001, do background checks, keep DPAs on hand, review code regularly, and implement zero-trust architectures.

Q3: The principal outsourced fintech development risks are:

Vendor dependence, IP dispute, regulatory failure, and exit sophistication. Minimize by having good contracts, ongoing monitoring, and in-house technical stewardship.

Q4: Months to construct a fintech MVP for every solution?

Outsourced: 4–6 months; In-House: 8–12 months, mainly because of recruitment and ramp-up time.

Q5: Should fintechs move from outsourcing to in-house as they grow?

They usually begin outsourced for economics and speed, then subsequently introduce central features in-house following Series A and the outsourcing of commodity features.

Make the right call for your fintech’s future.

Outsourced, in-house, or hybrid—your decision will shape your product’s speed, security, and scalability. Let’s map out the most cost-effective, compliant, and investor-ready approach for your next build.

Book your strategy session now.

![]()