In the hyper-competitive world of fintech today, speed is not just a plus—it’s a matter of survival. While established financial institutions take 18-24 months to bring new products to market, high-growth fintech scale-ups are shaving that time frame to 6-9 months with smart engineering partnerships. What separates market leaders from laggards too often is a single key variable: how fast they can turn ideas into market-ready offerings.

For U.S. fintech and insurtech CTOs and product leaders, the stakes have never been higher to speed time-to-market without sacrificing security, compliance, and quality. The right engineering partner can be the catalyst that turns your product roadmap from bottleneck to competitive advantage.

• Strategic engineering collaborations can lower fintech time-to-market by 40-60% with specialized knowledge and established frameworks

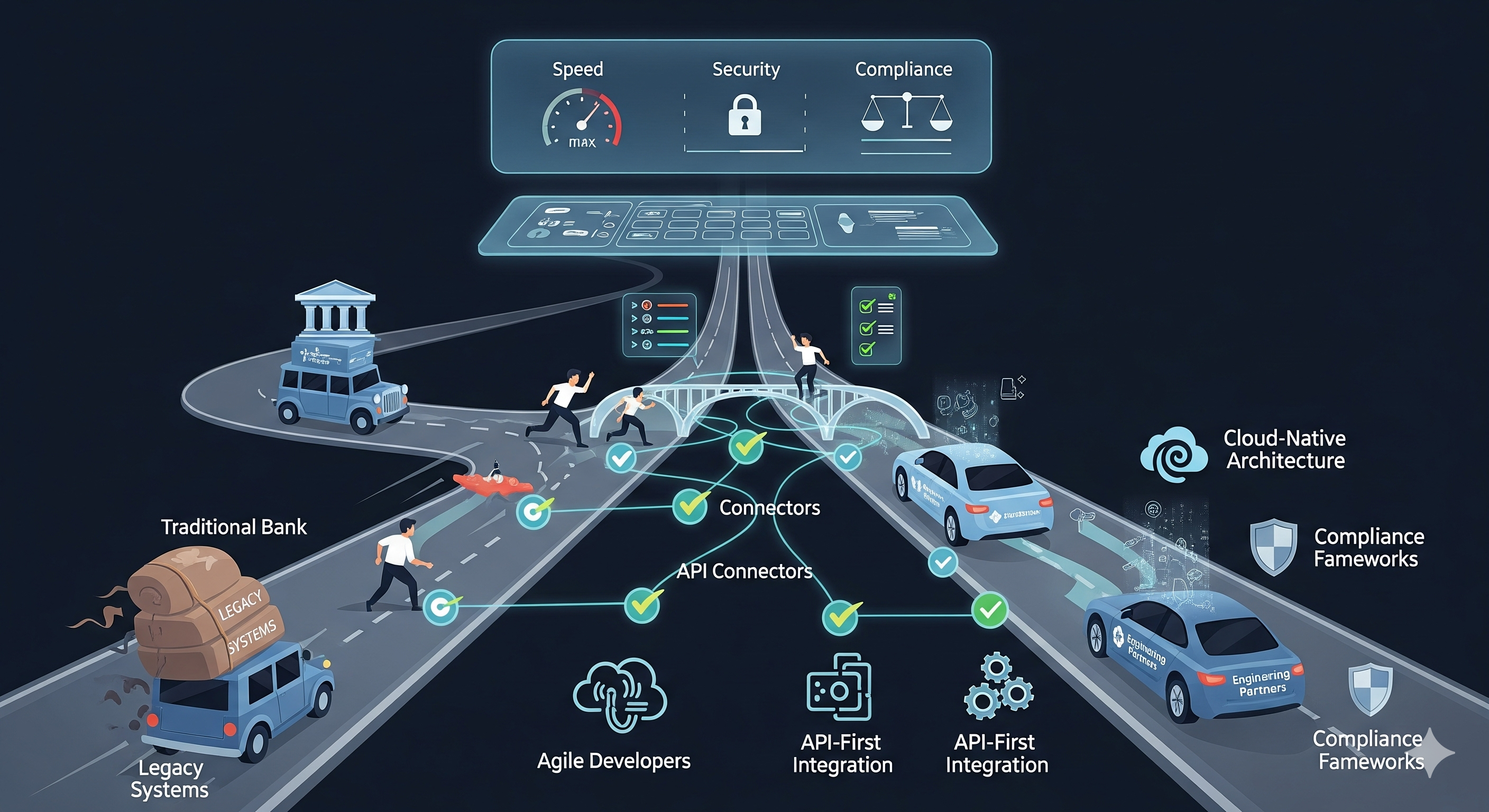

• Legacy system modernization and API-first architecture are the building blocks of speed without compromising security or compliance

• The proper partner adds domain knowledge in financial regulations, cutting compliance delays that otherwise add 3-6 months to projects

• Established methodologies such as rapid prototyping and iterative deployment allow for faster validation and market entry

The Real Cost of Fintech Market Delay

Fintech time-to-market delays are not only frustrating—they’re threatening to one’s existence. Research by McKinsey states that fintech firms launching products 6 months behind the competition are grabbing 33% less revenue in the first five years than pioneers.

Take into account the compound effect: each month of slippage results in competitors capturing market share, customer acquisition cost rising, and investor confidence dropping. For the average B2B fintech solution with a $50M total addressable market, a 6-month slippage will cost $8-12M in missed revenue opportunity.

What Actually Causes Engineering Delays in Fintech?

The most prevalent culprits of long development times are:

Legacy System Integration Complexity: 73% of respondents indicate that integration with legacy systems contributes 4-8 weeks to each major release cycle. These legacy systems, constructed on decades-old technology, demand expert-specific knowledge and prudent migration plans.

Compliance and Security Requirements: Banking regulations such as PCI DSS, SOX, and state-level compliance generate several cycles of review. In the absence of proper expertise, compliance validation alone will take 3-6 months from product launch times.

Technical Debt Build-up: High-velocity early-stage development tends to generate technical debt that ultimately hinders momentum. Teams indicate that they spend 30-40% of development time on maintenance and not new features.

Specialized Technology Skill Gap: Contemporary fintech demands proficiency in technologies such as blockchain integration, real-time payment processing, and enhanced security protocols—capabilities costly and time-consuming to acquire internally.

The most effective fintech scale-ups have one thing in common: they utilize specialized engineering partners to break speed walls with quality and compliance in place.

Domain Expertise That Makes a Difference

Specialized fintech engineering partners are not the same as generic software development companies. They have battle-proven expertise in the financial services sector, so they know the subtleties of payment processing, regulation compliance, and financial data protection from day one.

This knowledge comes into immediate play. While internal staff could take weeks studying compliance needs or payment gateway integration, seasoned partners can deploy known-good solutions within days.

Pre-baked Components and Frameworks

Established engineering partners keep libraries of pre-baked compliance-enabled components for shared fintech functionality:

KYC/AML verification process flows

Payment processing integrations

Fraud detection logic

Regulatory reporting templates

Security audit frameworks

These pieces of the puzzle can cut development time for core functionality 60-80%, so that teams can concentrate on value propositions that are differentiated instead of having to reinvent the typical financial services foundation.

Modernization vs. Rebuild: Making the Right Architecture Decision

One of the most key decisions that can have a tremendous effect on time-to-market is whether to modernize or rebuild.

When Modernization Accelerates Time-to-Market

Legacy system modernization typically offers the quickest route to market when:

Core business logic is solid but locked in legacy technology

Customer information and transaction history need to stay intact

Regulatory compliance has already been established

Budget limitations prefer incremental enhancement over full replacement

Stuck on whether to modernize or rebuild your fintech app?

Talk to a solution architect

The Rebuild Advantage for Speed

Full rebuilds can ironically be quicker when:

Legacy systems incur more technical debt than value

Modern architecture needs (API-first, microservices) are inherently incompatible because of the legacy systems

Compliance needs have changed dramatically since initial build

Scale demands outpace modernization capabilities

API-First Architecture: The Speed Multiplier

Successful fintech businesses that consistently realize fast time-to-market use API-first architecture as a core part of their strategy. It generates several benefits in terms of acceleration:

Parallel Development: Separate system components are developed in parallel without blocking dependencies.

Third-Party Integration Velocity: API-first architecture supports quick integration with payment processors, banks, and regulatory systems.

Future-Proof Scalability: Appropriately designed APIs support new features and integrations without the need for core system redesign.

Compliance Effectiveness: API boundaries simplify the installation of security controls and audit trails meeting regulatory standards.

How Does API-First Architecture Decrease Development Time?

API-first architecture decreases development time by several mechanisms:

Decoupled Development: Backend and frontend teams can work separately after API contracts are established

Reusable Components: API endpoints can be used by multiple applications and use cases

Simpler Testing: Each API endpoint can be tested and validated separately

Simplified Integration: Uniform API formats minimize integration challenges with external systems

The Compliance Acceleration Framework

Regulatory compliance is usually the largest unknown in fintech time-to-market planning. Seasoned engineering partners apply established compliance frameworks that turn regulatory mandates from project risk into definable project phases.

Efficient Audit Preparation

Instead of addressing compliance as an afterthought, strategic partners embed compliance documentation and audit preparation throughout the development process. This eliminates end-of-project compliance bottlenecks that can take months off launch timelines.

Regulatory Expertise by Jurisdiction

U.S. fintech regulation differs widely across states and types of financial services. Partners with strong regulatory knowledge can navigate these requirements effectively, sidestepping expensive delays through compliance errors.

Measuring Time-to-Market Success: Key Metrics That Matter

Effective time-to-market acceleration calls for transparent measurement frameworks. The best fintech teams monitor:

Development Speed: Feature delivery or story points per sprint, trending over time Time to First Customer: Concept approval through first paying customer Regulatory Approval Time: Average compliance validation and approval time Technical Debt Ratio: Ratio of maintenance time to development time in relation to new features

What is a Reasonable Time-to-Market Improvement?

Fintech industry information indicates that fintech organizations collaborating with professional engineering partners generally realize:

40-60% reduction in initial product launch duration

30-50% shorter feature delivery cycles

70-80% elimination of compliance-related delays

50-70% better development predictability

Risk Mitigation in Accelerated Development

Faster without risk management is irresponsible. The most successful accelerated development projects utilize parallel risk mitigation techniques:

Security-by-Design: Developing security controls along with development processes instead of tacking them on as an afterthought Continuous Compliance Monitoring: Automated checks that ensure regulatory compliance during development Incremental Rollout Strategies: Phased deployments that allow for quick feedback and correction Comprehensive Test Automation: Automated testing that preserves quality while allowing for quick iteration

Selecting the Right Engineering Partner to Accelerate Time-to-Market

Not every engineering partnership yields time-to-market advantage. The best partnerships have certain traits to them:

Domain-Specific Track Record

Seek out partners with a track record in your target fintech vertical. Payment processing know-how does not necessarily extend to lending platform understanding, and insurtech needs are quite different from standard fintech requirements.

Regulatory Compliance Expertise

Partners should have extensive knowledge of applicable regulations and hold up-to-date certifications. Request explicit examples of compliance gain in comparable projects.

Technology Stack Alignment

The technology skills of the partner should match your existing and future architecture needs. Misaligned technological selections can be bottlenecks to integration that offset speed advantages.

Cultural and Communication Fit

Acceleration in time-to-market demands intense cooperation and speedy decision-making. Partners need to exhibit communication styles and project management strategies consistent with your working style.

The Future of Fintech Development Speed

New technologies and approaches keep advancing the limits of what is possible in fintech time-to-market acceleration:

AI-Helped Development: Machine learning technology is starting to automate repetitive coding and speed up test cycles.

Low-Code/No-Code Integration: Hybrid approaches that leverage low-code tools to support rapid prototyping while preserving custom development for critical functionality.

Cloud-Native Architecture: Serverless and containerized deployments that save infrastructure setup time and provide instant scaling.

Implementation Roadmap: Getting Started with Time-to-Market Acceleration

Phase 1: Planning and Assessment (2-4 weeks)

Audit of existing system architecture

Mapping of compliance requirements

Technical debt determination

Partner selection and evaluation

Phase 2: Building the Foundation (4-8 weeks)

API architecture design

Implementation of security framework

Setup of development environment

Setup of initial compliance framework

Phase 3: Fast Track Development (8-16 weeks)

Core feature development with concurrent workstreams

Continuous integration and testing

Continuous compliance validation

Inclusion of user feedback

Phase 4: Preparation for Launch (2-4 weeks)

Final validation of compliance

Completion of security audit

Performance testing and optimization

Launch strategy implementation

Want to learn how fintech scale-ups such as yours achieved a 50% reduction in time-to-market with the proper engineering partner?

Schedule a free consultation

Speed as a Strategic Advantage

In today’s fast-paced fintech environment, acceleration in time-to-market is not about getting to market quicker—it’s about creating organizational capabilities that deliver long-term competitive advantage. The ideal engineering partnership offers not only short-term development acceleration but also knowledge transfer and process improvement that transfers to every subsequent project.

The companies that will dominate fintech markets over the next decade are those that master the balance of speed, security, and compliance. Strategic engineering partnerships provide the expertise and frameworks necessary to achieve that balance while maintaining the agility essential for scale-up success.

The question is not whether you can afford to invest in time-to-market acceleration—it’s whether you can afford not to in a space where first-mover advantage frequently drives long-term success.

Frequently Asked Questions

How fast can a fintech firm get a new product to market with the right engineering partner?

With a seasoned engineering partner, fintech businesses can generally deploy MVP products within 3-6 months, as opposed to 12-18 months with more conventional development methods. The actual timeframe will vary based on product complexity, regulatory imperatives, and integration with existing systems.

What is the single biggest reason why fintech product development is slower?

Legacy system integration and compliance mandates are the biggest time sinks for fintech development. Properly experienced companies spend 40-60% of their development time struggling with these issues, while seasoned partners can cut this down to 15-20% by leveraging established frameworks and pre-existing solutions.

How do you ensure security and compliance when speeding up development?

Security and compliance acceleration involves building these requirements into the development process from day one, not as end-of-life checkpoints, but through automated compliance monitoring, security-by-design tenets, and ongoing audit readiness across development cycles.

What do I look for when considering engineering partners for fintech projects?

Most important to evaluate are domain expertise in your fintech space, up-to-date regulatory compliance certifications, the capability to deliver with similar time-to-market speedup projects, alignment with your specifications in terms of the technology stack, and fitting within your culture for co-op rapid development.

Should existing systems be upgraded or newly built from scratch for quicker time-to-market?

The choice rests with various considerations: the state of current systems, compatibility with contemporary architectural needs, compliance status against regulations, and budget. Generally speaking, modernization is quicker when business logic is good in core areas, whereas rebuilds work best when legacy systems generate a lot of technical debt or compliance issues.

![]()