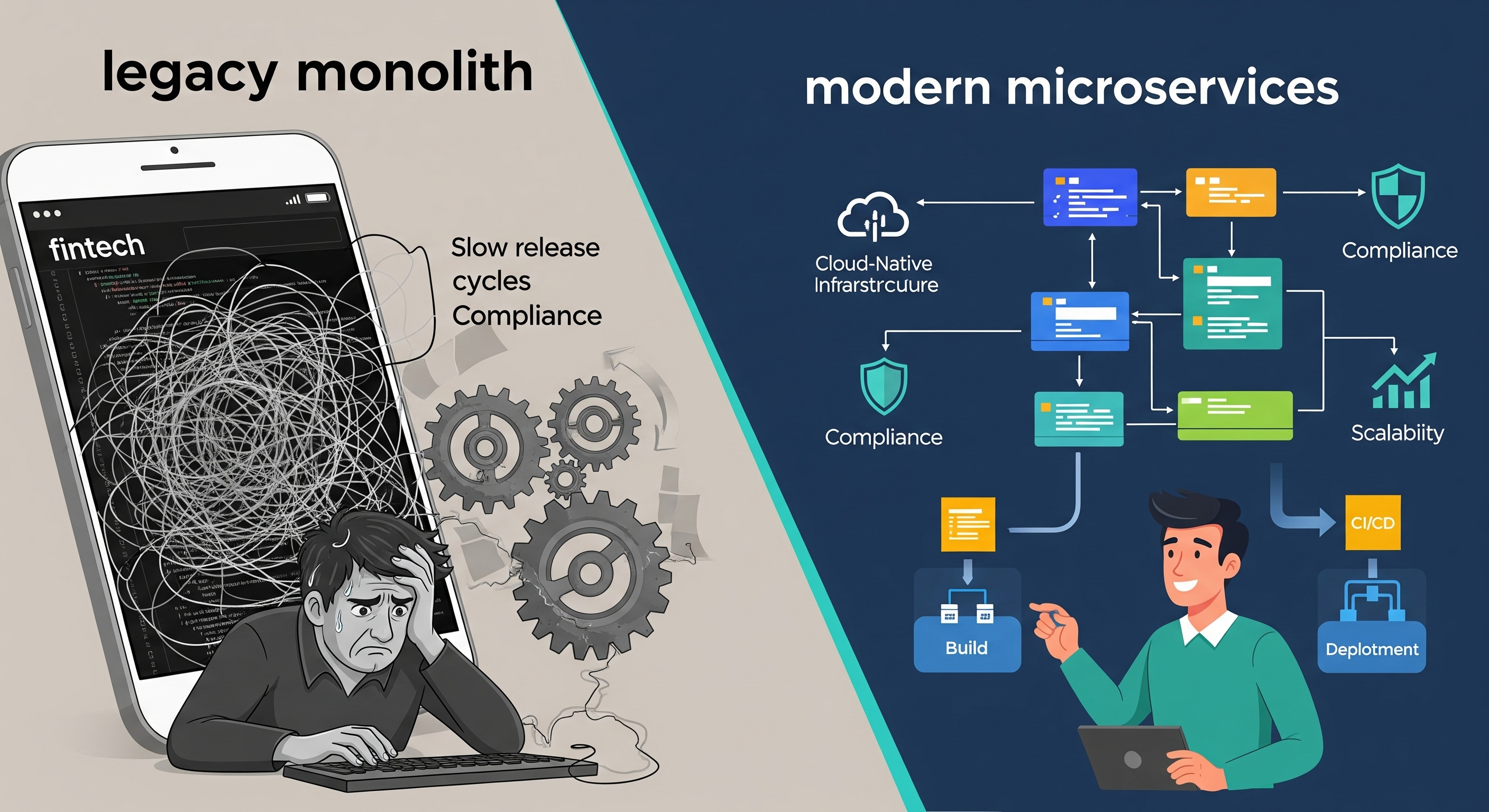

Legacy code is the Achilles’ heel of most high-growth fintech and insurtech scale-ups. With increasing teams and accelerating customer expectations, old code, rigid architectures, and security flaws can slow down innovation. You’re not alone if you’re wondering: Do we modernize what we have—or rewrite it from scratch?

In the high-stakes American fintech ecosystem, that choice can affect everything from your product strategy to your compliance position.

Legacy fintech app modernization can be quicker and safer if business logic is dependable.

Rebuilding provides clean architecture and flexibility but takes longer and requires more initial investment.

The primary deciding factors are tech debt, compliance risk, engineering velocity, and scalability objectives. These elements will guide your decision on whether to refactor or rebuild.

Start with an audit—then develop a roadmap tied to your product vision and regulatory needs.

What Is Legacy Modernization in Fintech?

Legacy modernization is the act of upgrading existing systems to newer, more scalable, and secure architectures—with zero rebuild. It can include refactoring code, introducing APIs, database migration, or cloud migration. This can involve various strategies such as re-architecting, re-platforming, or re-hosting applications. These strategies aim to improve performance and scalability and maintainability to adapt to evolving business needs. maintainability without a complete overhaul.

Common signs you need modernization:

New engineers have trouble onboarding

Compliance issues (e.g., SOC2, SOX, GDPR)

Sluggish release cycles

Poor integration with contemporary tools or APIs

High maintenance expense

The cost of maintaining legacy systems often outweighs the investment in modernization.

What is legacy system modernization for fintechs?

Modernization within fintech tends to concentrate on enhancing compliance automation, developer productivity, and customer experience—leaving behind core logic that continues to function.

Rebuild vs. Modernize—What’s the Difference?

|

Criteria |

Modernize |

Rebuild |

|

Timeline |

Quicker (3–6 months) |

Longer (6–12+ months) |

|

Cost |

Lower upfront |

Higher upfront, but long-term value |

|

Risk |

Lower technical risk |

Higher but cleaner slate |

|

Compliance |

Improved incrementally |

Can embed compliance from day one |

|

Architecture |

Evolve existing |

Redesign completely |

Unsure if you should modernize or replace your fintech app?

Talk to a solution architect →

When to modernize:

-

Business logic is sound

-

The application is mission-critical and needs to be stable

-

You need quick compliance or integration wins and improved developer experience.

When to rebuild:

-

Architecture is fundamentally broken

-

Legacy tech stack can’t scale (e.g., monolith to microservices)

-

You are proposing significant new features or pivots

-

You need to replace outdated technology with modern solutions.

The Key Factors to Guide Your Decision

1. Codebase Complexity

Legacy codebases with tight coupling and zero test coverage are biased towards rebuilds. If your organization is having trouble pushing code safely, it’s a red flag.

2. Time-to-Market Pressure

Need to get new features out yesterday? Modernization enables quicker iteration with less overhead.

3. Regulatory & Compliance Environment

Modernized systems can assist in incorporating compliance checks into CI/CD pipelines. Rebuilding provides an opportunity to plan for compliance from day one. This allows for automated testing and continuous integration, ensuring that compliance is a built-in feature rather than an afterthought.

4. In-House versus Outsourced Engineering

If your in-house organization is not experienced in modernization, outsourcing can minimize risk. Working with experienced fintech engineering teams ensures scalability and security.

The decision to rebuild or modernize a legacy fintech application is a critical one, with significant implications for the business’s future. By carefully considering factors such as codebase complexity, time-to-market pressures, regulatory requirements, and in-house engineering capabilities, businesses can make an informed choice that aligns with their strategic goals and ensures long-term success.

What does a product engineering partner that fintech companies should be looking for do?

Seek out teams with established fintech expertise, SOC2-prepared processes, and the capacity to deliver through modernization, security, and DevOps.

A strong product engineering partner can help you navigate these complex decisions, offering expertise in both modernization and rebuilding strategies. They can assess your current tech stack, understand your business objectives, and recommend the most effective path forward, ensuring your fintech application remains competitive, secure, and compliant.

From Monolith to Microservices: How This Insurtech Slashed Dev Time by 40%

A mid-sized insurtech in the U.S. had a legacy PHP monolith with painful release cycles. After a code audit, they opted for a hybrid approach—modernizing backend services into Node.js microservices while keeping the core data model.

Outcome:

Time to resolution shortened from 3 weeks to 3 days

Onboarding time for newly hired engineers reduced by half

Regulatory audit prep reduced by 60%

Why Modernization Is Not “Lift-and-Shift”

Most teams equate modernization with just a lift and shift to the cloud. Real modernization comprises

Rearchitecture to microservices or serverless

Replatform databases (for example, from SQL Server to Postgres or DynamoDB)

Adding observability using instrumentation like OpenTelemetry

CI/CD pipeline optimization for faster deployments

Selecting the Appropriate Product Engineering Partner

Your engineering partner choice can make or break your rebuild or modernization initiative. Key characteristics to seek:

Experience in U.S. fintech regulatory environments

Dedicated DevSecOps and QA practices

Agile delivery frameworks (Scrum, Kanban)

Proven playbooks for legacy migration

Explore our Product Engineering Services

Read related blog: 5 Warning Signs You’ve Outgrown Your Fintech Stack

Want to see how fintech scale-ups like yours reduced time-to-market by 50% with the right engineering partner?

FAQs

1. What is legacy modernization in fintech?

It’s the method of modernizing mature systems to new infrastructure without complete rebuilds. Consider refactoring, API connectivity, or cloud-native conversions.

2. Is it more cost-effective to rebuild or modernize a fintech application?

Modernization tends to be less expensive to begin with, but rebuilding will yield higher long-term ROI if the old system is inherently defective.

3. How long does it take to modernize fintech legacy?

Typical project timelines are 3–9 months based on complexity and objectives.

4. Can I safely outsource fintech app modernization?

Yes—with the proper partner. Seek out SOC2, GDPR, and DevSecOps-capable engineering teams.

5. What happens if legacy fintech systems aren’t updated?

Security vulnerabilities, compliance issues, slow releases, and developer burnout from poor DX.