Bandhan Bank is a leading financial institution with a strong presence across India, offering a range of banking and financial services. As the bank expanded, it required a modern, efficient, and scalable approval workflow to replace traditional manual processes, ensuring transparency, faster decision-making, and an improved user experience for employees.

Bandhan Bank’s traditional approval process was slow, inconsistent, and lacked visibility, leading to inefficiencies in internal decision-making.

Despite these hurdles, Cipla aimed to create a seamless experience for its users, reinforcing its commitment to innovation and accessibility in healthcare.

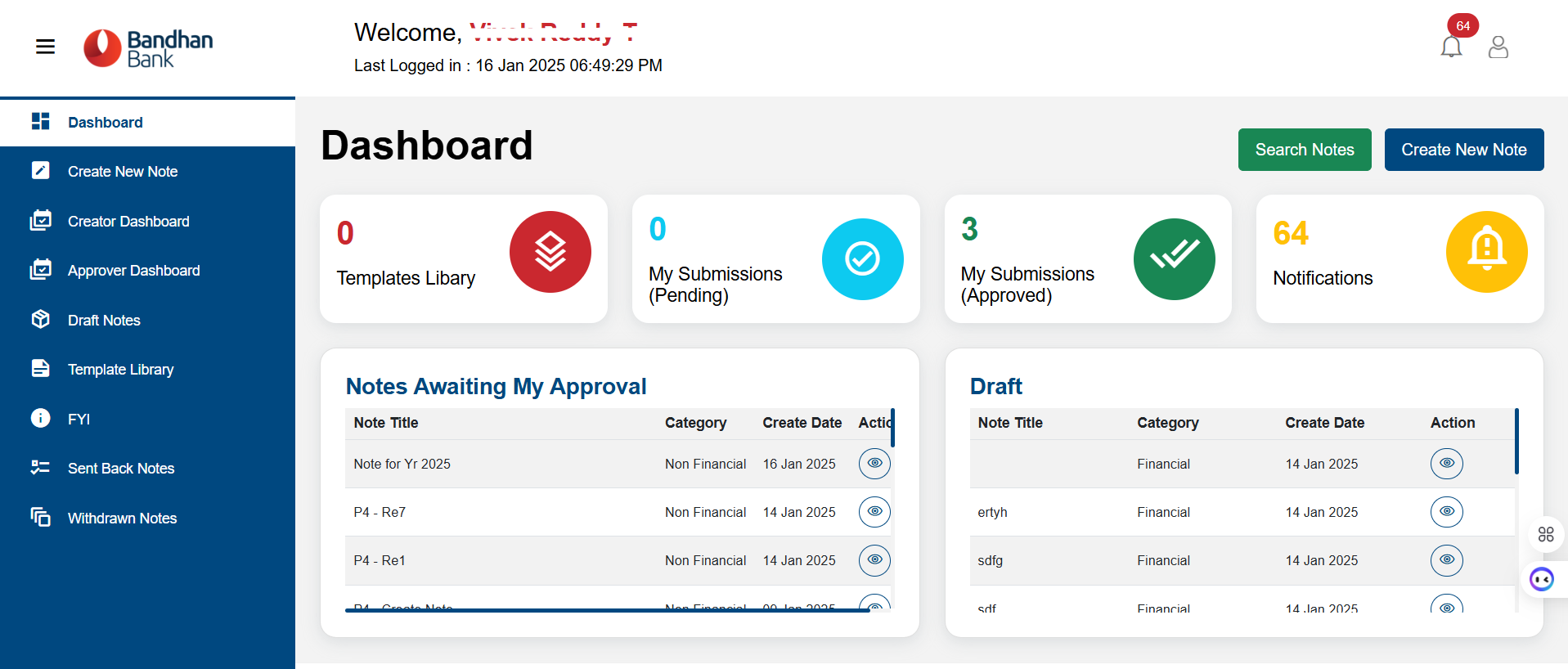

INT. developed and deployed a Digital Note Approval System (DNAS), a secure, scalable, and transparent workflow automation solution tailored for Bandhan Bank’s internal approval processes.

Mobile-Responsive UI: Enabled executives and managers to approve requests on the go, ensuring business continuity.

The implementation of DNAS led to significant efficiency gains, user satisfaction, and enhanced governance.

Users onboarded and using this application

Improvement in User Satisfaction Scores

We see INT. as a future partner for their own expansion. After almost a decade of working together, we will need INT’s support for our new steps in the growing markets.