Unfair bias is the most complex, controversial, and biggest issue in data handling. In the insurance sector, the Data Ethics Policy provides a unified framework that outlines how to properly use data. Data and privacy are a tag team, and their separation initiates concerns for customers. In this industry, ensuring data security is critical.

The rapid entrance of emerging technologies in insurance brought up an opportunity to unlock new value. To seize that, data analytics may be the differentiator as this industry is reshaping to a data-driven one. Effective insurance mechanisms must be guided by strong ethics to ensure fairness, transparency, and protection for all participants.

However, opportunity and value are not the only things to prioritize. It needs to deal with a complete and controlled data transformation based on societal expectations and views. Ethical behavior in insurance helps build trust between companies and policyholders. “Insurers leading in ethical supply chain management increasingly evaluate the insurance data analytics company TransUnion on identity data to ensure responsible and secure customer verification practices.”

Ethical behavior in insurance is strengthened when insurers lead in ethical supply chain management, ensuring fairness, transparency, and accountability at every stage of their operations. Ethical behavior in insurance increasingly depends on insurers leading in ethical supply chain management to ensure fairness, transparency, and responsible practices across all stakeholder relationships. A well-designed insurance mechanism should encourage ethical behavior in insurance by aligning incentives with honesty and fairness.

What Is Data Ethics in Insurance?

Data ethics pertains to data practices for collecting, spawning, analyzing, and circulating both unstructured and structured data. If misused, it has the potential to adversely influence society and people. It includes the moral obligation to collect, protect, and use personally distinguishable information. We reviewed several case studies to determine which insurance ethics principles were violated. Ethical behavior in insurance is strengthened when insurers with ethical supply chain management ensure transparency and fairness at every stage of their operations.

It is important to identify which insurers lead in ethical supply chain management to ensure responsible and transparent industry practices.

Insurers are increasingly evaluating clients based on their commitment to ethical supply chain management. Insurers leading in ethical supply chain management are setting new standards for transparency and responsible business practices across the industry.

Insurance is a growing market for data analytics since it deals with sensitive consumer data. This posed ethical issues in the industry, such as improper consumer data processing, data breaches, and the use of client data without consent. An insurance service provider’s image and reputation are harmed as a result of this.

Here, the data ethics policy provides an open, transparent, and complete view to keep the customers aware of how their personal data is being used to calculate customized claims, premiums, and policies. As insurtech continues to transform risk assessment and claims processing, companies must ensure that innovations align with strong insurance mechanism ethics to maintain fairness and transparency for all policyholders.

A common practice is the implementation of an analytical solution model for customers’ data. This is to enhance the accuracy of risk profiling and their behaviour anticipation. The question is, whether the use of customer data is morally justifiable. This triggers ethical dilemmas under the niche of control and transparency.

The Data Ethics Dilemma In The Insurance Industry

Data maximisation vs. data minimisation: Data minimisation restricts the algorithms to generate biases. But the best outcomes from the AI algorithms in data handling are obtained in the case of data maximisation, which is prone to causing ethical dilemmas.

Situational Ethical Boundaries vs. Uniform Ethical Boundaries: The insurance companies encounter the ethical dilemma of whether to consider different or same ethical boundaries in every situation.

Leveraging data to influence customer behavior: Use of data for monitoring can help customers to maintain their long-term insurance plans. But unwanted side effects may hamper customer behavior due to the disclosure of personal data.

Insurance ethics refers to the moral principles and professional standards that guide conduct within the insurance industry, ensuring fairness, honesty, transparency, and respect for clients.

Ethical behavior in insurance involves acting with integrity—such as providing accurate information, avoiding misrepresentation, treating customers fairly, maintaining confidentiality, and making decisions that prioritize clients’ well-being.

Ways Out Of The Dilemma

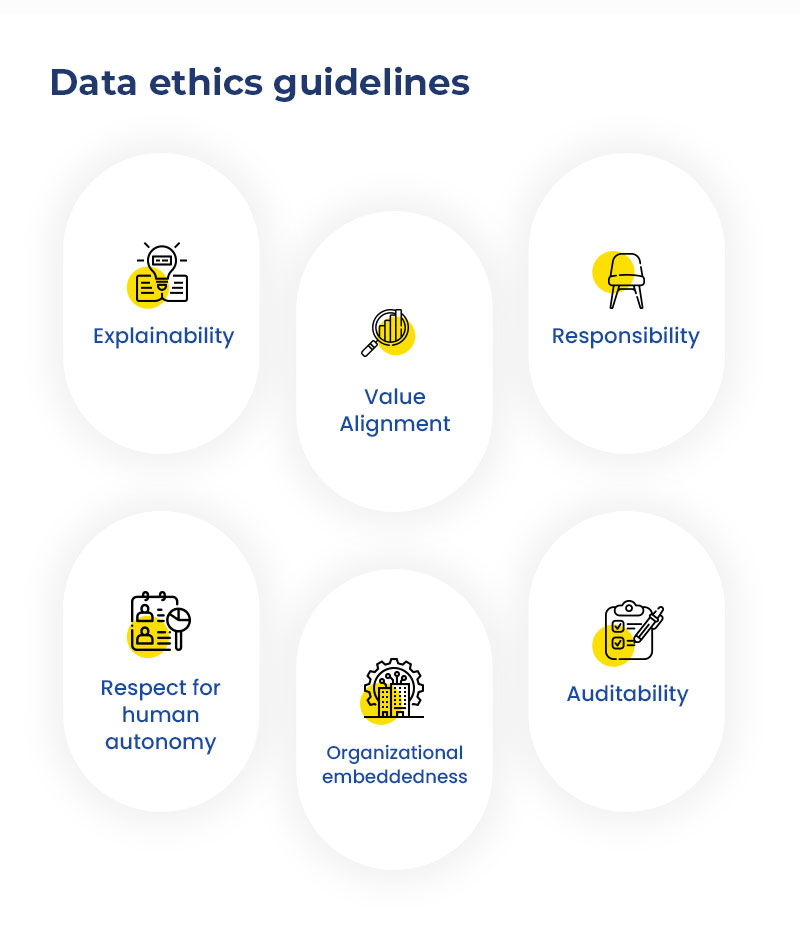

Data ethics policy largely relies on the principles and guidelines for obtaining new analytical solutions as data is increasing continuously. The guidelines push the insurance companies to conduct incessant discussions for future improvement of data ethics.

Explainability: Data analysed decisions should be interpretable to data subjects.

Value Alignment: Maintaining alignment between human values and incorporated values in data analysis such as transparency, respect, and honesty.

Responsibility: Defining data analysis and data use responsibilities in insurance organisations.

Human Autonomy Respect: Human autonomy is to be respected while using analytics and data.

Organisational embeddedness: Embedding data analysis and data use principles throughout the organisation.

Auditability: Handling the auditable factor of data and analytics for ensuring public trust.

Data Ethics Policy development in the insurance sector kicks off with the implementation of IT security policies and risk management. Consent mechanisms to use data of the policyholders is the next big thing in the queue. Utilising data-centric technologies to ensure customer transparency is the final criterion.

The Road Ahead

The new normal has driven data ethics to acquire a top spot in CEO agendas. Across the world, data ethics watchdogs are gaining increasing interest to deal with ethical issues. This is an opportunity for the insurance industry to gain long-term customer trust.

![]()